On the first day after The Trade Desk (TTD) share split, the US share rose sharply. The stock could thus become, for example, what statisticians have already been able to determine with other split stocks.

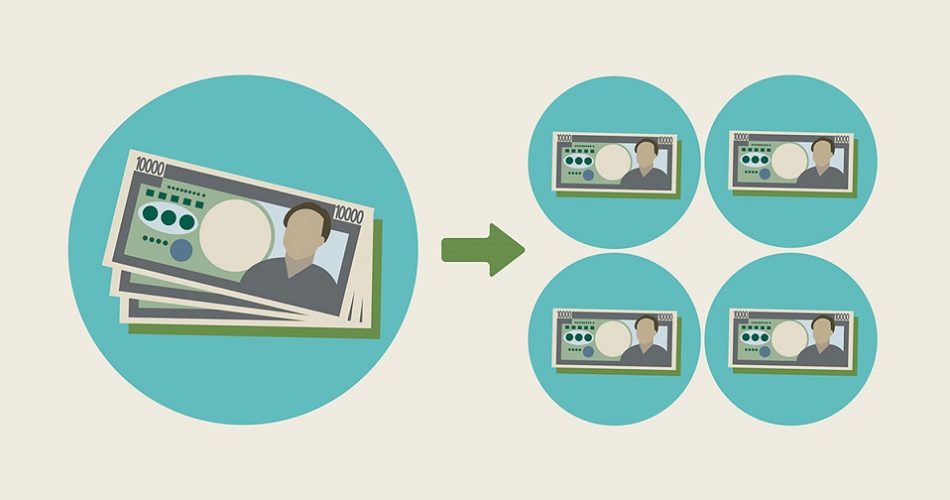

Instead of one share, TTD investors have had ten papers from the US software company in their depot since Thursday. Not the only thing that has increased massively with the share split. Because the price also climbed over five percent the day after the corporate action and the trading volume with 9.1 million traded papers was significantly higher than the previous average of 0.94 million.

Investors seem to be banking on a phenomenon that has been known for a long time: in the event of a stock split, new investors are to be attracted due to the optical cheapness of the share. In any case, this special situation can be determined purely statistically. David Ikenberry from the University of Illinois has shown in two studies in 1996 and 2003 that the split stocks develop on average around eight percent better than the market as a whole in the year after the split.

Due to this historical outperformance, DER AKTIONÄR launched the Split Pot Index last August in order to give our readers the opportunity to benefit from this special situation on the market. The TTD share is also one of ten index members.

TTD combines technology and advertising

TTD was one of the big shooting stars on the stock exchange in 2020, benefiting from the ongoing trend away from traditional to digital media, especially during the pandemic. The software company has what it takes to become the market leader in “programmatic advertising” because it has algorithms and its own computing power that revolutionizes the advertiser’s purchase of ads.

After a detailed analysis, the specific advertising is only played out to those Internet users who have a high probability of buying the advertised product. But TTD software is not only used in the browser – Connected TV also brings strong growth. It will be exciting here when some of the leading streaming services such as HBO, Netflix & Co switch to an ad-supported model.

TTD delivers a promising story, even if the share had to vent a little after the rapid rise in 2020. From a purely statistical point of view, however, the chances are good that the share should outperform again after the split.

However, in order to really rely on the split effect, it is worthwhile to spread the list of candidates a little wider. THE SHAREHOLDER recommends the Split Pot Index to interested investors, in which you can invest thanks to the products of our partner Morgan Stanley.