Monega Kapitalanlagegesellschaft (KAG) mbH grew strongly across all fund segments in the past financial year. The number of securities funds that Monega manages increased from 71 to 85. Funds. At the same time, the Cologne-based company was able to significantly increase the volume in public and special funds (segments) as well as in administration despite the ongoing corona pandemic. In January 2021, the mark of 6 billion euros in assets under management / administration was significantly exceeded.

“We are very satisfied with the positive business development in the past year despite the corona pandemic,” said Christian Finke, Managing Director of Monega KAG, on the company’s results. “It is particularly gratifying that we have again been able to significantly increase the number of our funds and fund partners.”

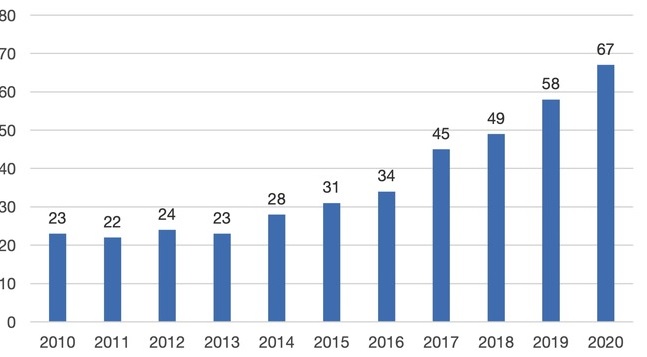

Business with cooperation partners is still the main growth driver for Monega. The company now manages around 3 billion euros in 67 mutual funds, 50 of which are partner funds. Partner funds are mutual funds that Monega sets up together with selected partners on specialized investment topics. New among the meanwhile 30 fund partners are the CLO specialist Infinigon, the Mittelstands-bond boutique KFM, the Steyler Ethik Bank (Germany’s oldest ethical bank), the CSR consulting company and the Asset Manager Christian Hintz Vermögensverwaltung, Michael M. Zeller (Investagram) and Sonnenburg Investments.

“With the new KirAc foundation fund alpha and the takeover of BIB Sustainability Aktien Global and the three Steyler Fair Invest funds, we have systematically expanded the area of sustainability,” explains Monega managing director Bernhard Fünger. Monega now offers its investors 25 sustainably managed and broadly diversified range of mutual funds according to investment style and investment region.

Monega has also expanded its business with institutional customers. In the area of financial portfolio management, which enables Monega to manage funds (segments), third-party KVGs or direct portfolios of institutional customers as well as consolidated securities portfolios (master KVGs), the company now manages mandates with a volume of 680 million euros. This also includes the first cross-border financial portfolio management of a public fund domiciled in Luxembourg in the amount of more than 200 million euros. Monega’s special fund assets and financial portfolio management mandates currently amount to around 3.2 billion euros. In total, Monega currently manages a volume of 6.2 billion euros.