The self-made billionaire Mark Cuban (“Shark Tank”), usually one of the loudest advocates for crypto assets like Dogecoin and recently an avowed fan of yield farming and liquidity mining, is concerned. Strangely enough, this time because of the unregulated crypto sphere. Because he had to experience first-hand how an investment suddenly vanished into thin air and, like many others, he could only watch the price plunge to zero.

We are talking about Iron Finance and its stablecoin IRON. This is a rather unusual financial product from the wild “decentralized finance” corner that tried a new approach. While other stablecoins like Tether (USDT) or USDC are (supposedly) backed by certain other values like bonds, loans, corporate bonds, trust deposits and promissory notes, the makers of IRON took a new approach. 75 percent of IRON is to be secured from the other stablecoin USDC, and the rest by the newly created TITAN token, which in turn is to form its price on the market. The castle in the air was christened “Multi-Chain Partial-Collateralized Stablecoin”. “Please don’t buy TITAN or IRON” is now on the operator’s website.

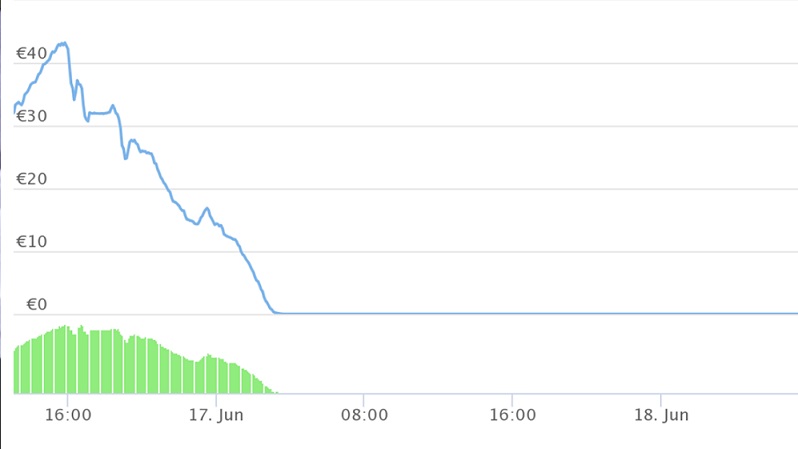

To zero in a few hours

Now, however, TITAN (also known as the “IRON Titanium Token”) has collapsed spectacularly. Within a few hours of the start of trading, the price of TITAN fell from around 30 to zero euros. Boom, bang, it’s all gone. Investors fled the asset as soon as they could and withdrew from the asset that runs on the polygon blockchain. “We never thought it would happen, but it just happened. We have just experienced the world’s first large-scale crypto bank run, ”the developers say.

The blame for the misery is a downward spiral that has accelerated itself. Because more and more users were selling, the protocol kept generating new tokens due to its programming, which increased the available amount and caused the price to drop further – panic broke out. The developers describe the processes as follows:

„Later, at around 3pm UTC, a few big holders started selling again. This time, after they started, a lot of users panicked and started to redeem IRON and sell their TITAN. Because of how the 10mins TWAP oracle works, TITAN spot price drops even further in comparison to the TWAP redemption price. This caused a negative feedback loop, as more TITAN was created (as a result of IRON redemptions) and the price kept going down. A classic definition of an irrational and panicked event also known as a bank run. At the time of writing this, the TITAN supply is 27,805 billion.“

The stablecoin project is as good as dead. The developers want to learn from it and bring new products to market in the future. There is nothing left to save on the stablecoin (does it even deserve this name?). “If people panic and run to the bank to withdraw their money in a short period of time, the bank can and will collapse,” write the makers. In the future, IRON and TITAN will stand as a memorial for poorly designed financial products in the DeFi world.

Mark Cuban: “There should be regulation”

And: Regulatory authorities could now feel compelled to take a closer look at the growing DeFi market. Because nothing is regulated by nature in the booming market segment, apart from the smart contracts that run on blockchains like Ethereum and define how a financial product (stablecoin, loans, etc.) works or not. If even a major investor like Mark Cuban with a lot of experience in the crypto market falls for a shaky thing like IRON / TITAN – what does that mean for the mass suitability of DeFi? The incident will have consequences.

“There should be a regulation that defines what a stablecoin is and what collateral is acceptable. There will be a lot of players trying to bring stablecoins into the market, ”said Cuban. Unusual words from an investor who calls himself a libertarian.