Berkshire Hathaway is a multinational conglomerate holding company based in Omaha, Nebraska, USA, that has become one of the world’s largest and most successful companies. The company was founded by Warren Buffett and his partner Charlie Munger in 1965, but it was not until the 1980s that Buffett began to transform it into the powerhouse it is today. The company’s success can be attributed to Buffett’s unique investment philosophy and his ability to identify undervalued companies and assets.

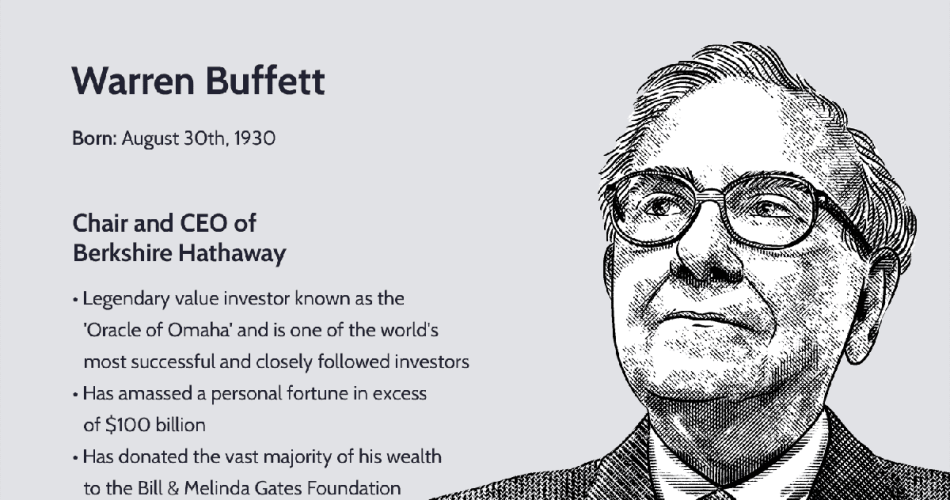

Warren Buffett, born in 1930, is widely regarded as one of the most successful investors of all time. He began his career in finance in the 1950s and quickly made a name for himself as a shrewd investor. His investment philosophy is based on value investing, which involves finding companies that are undervalued by the market and holding them for the long term. Buffett’s approach is often described as patient, disciplined, and focused on the fundamentals of a business.

Buffett became the CEO of Berkshire Hathaway in 1965 and began to acquire a diverse range of businesses, including insurance companies, retail businesses, and manufacturing firms. He also started to invest in publicly traded companies, such as Coca-Cola, American Express, and Wells Fargo. Over time, Buffett’s investments in these companies became some of Berkshire Hathaway’s most valuable assets.

One of the hallmarks of Buffett’s investment philosophy is his commitment to long-term thinking. He is known for holding onto his investments for years, if not decades, and for avoiding the short-term thinking that often drives the stock market. This approach has allowed Buffett to build a portfolio of companies that have consistently generated strong returns over the long term.

Buffett has also been known for his aversion to debt. He has always been conservative in his approach to borrowing money and has encouraged the companies that Berkshire Hathaway acquires to operate with minimal debt. This approach has helped to insulate Berkshire Hathaway from the financial crises that have affected other companies in the past.

Today, Berkshire Hathaway is one of the largest and most successful companies in the world. Its portfolio includes businesses such as GEICO, Dairy Queen, and Duracell, as well as significant investments in other companies, such as Apple and Amazon. In 2021, Berkshire Hathaway reported revenues of $278 billion and a net income of $42.5 billion.

Buffett, who is now in his 90s, has been an active CEO and investor for over 50 years. His investment philosophy and business strategies have been studied and emulated by investors around the world. He has also become known for his philanthropy and has pledged to give away most of his wealth to charitable causes.

In conclusion, Warren Buffett and Berkshire Hathaway have become synonymous with value investing and long-term thinking. Buffett’s approach to investing has allowed him to build one of the world’s largest and most successful companies, while also becoming a role model for investors around the world. While Buffett’s time as CEO may be coming to an end, his legacy and influence on the world of finance will undoubtedly continue for many years to come.